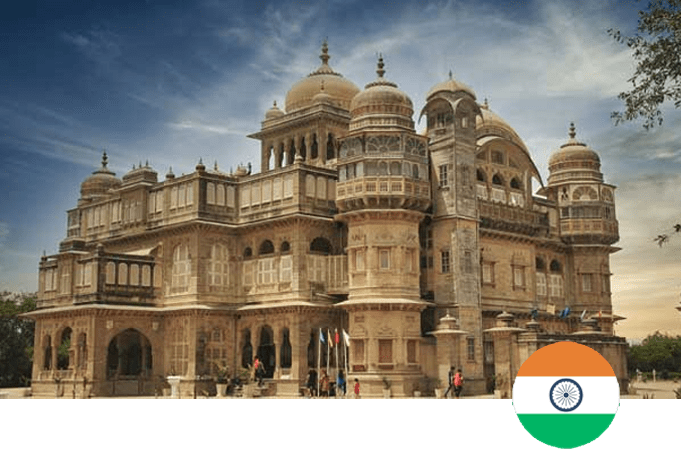

Labor laws and compliance in India

This guide has important information for businesses looking to hire employees or contractors in India. It’s the world’s second largest country by population and seventh largest by land. Today, India is a powerhouse in information technology and business process outsourcing industry. Every major outsourcing company in the world has a presence in India. The country accounts for more than 50% of all outsourcing business in the world.

Minimum Wage

Based on job type

Overtime Wage

2x Regular Wages

Meal Breaks

30-60 Minutes

Rest Breaks

No federal mandate

Working hours

8 hours/day, 48 hours/week

Salary Payment Cycle

Monthly

Payroll Taxes

Provident Fund, ESI

Paid Vacation

15 days

Overtime Hours

Beyond 48 hours in a week

Night Shift Hours

Usually paid at 110% of regular pay Between 7PM and 6AM

Holidays

12 holidays/year

No Work Days

Sunday, voting days for federal and state elections

A business needs a local entity in India to hire locally. You will need to register a subsidiary in India, get a local office address, tax registration, employer registration, and bank account. The business and tax registrations can take several weeks to complete.

You will also need to comply with benefits, payroll, tax, and HR laws. These laws vary between different states. If you want to take advantage of the vast labor pool by hiring in multiple cities, you will need to hire an experienced team to stay compliant everywhere.

India differentiates between employees and contractors. There are different rules for both, and incorrect classification can lead to fines.

With HiveDesk, you can bypass all these legal issues and get started in hust q week with your remote team in India.

India has a complex minimum wage structure. The central government fixes overall minimum wage but state governments also set minimum wages for factory and farm workers. There is no statutory minimum wage for businesses outside the manufacturing sector.

For manufacturing and farm sectors, India has 2,000 different types of jobs with several hundred categories of employment. Each employment category and job type has a minimum daily wage. This makes it hard to hire industrial workers in India.

HiveDesk customers usually hire white collar employees in India who are not subject to the minimum wage rules. But you need to pay competitive salary to attract good talent.

Employees in the IT industry generally work for 40 hours in a week, with Saturday and Sunday as holidays. But the law allows only one weekly off so the work hours can go up to 48 in a week.

If you plan to hire a white collar employee in India, you should plan on a 40-hour work week to attract good employees.

Factory workers are paid overtime pay at twice the rate of regular pay. But most IT workers do not get overtime pay in India.

Employers typically follow a monthly payment schedule, with salaries aid on the first of every month. Salary prorated for employees joining in the middle of a month. Salary is calculated on monthly basis, not hourly, as is the case in the US and many European countries.

- Salary in India has several allowances apart from the basic pay. Most employers break up the total compensation into basic pay, dearness allowance, house rent allowance, medical allowance, and travel allowance. Some of these are tax deductible for employees if they produce a receipt for related expenses.

Salary is paid into employee’s bank account on the first of every month, net of deductions. Employers must deduce income tax at source, contribution to provident fund (social security) and government’s employee health insurance (if applicable).

Individual Income Tax

Only the central government can impose income tax in India.

Indian income system follows a slab structure. It means individuals pay income tax based on their income level. This is also called the progressive tax system in which individuals with higher income also pay higher taxes. These tax slabs are revised in every annual budget. Employers need to stay on top of these changes to be compliant with tax laws.

Employees pay 12% of the salary towards provident fund which is India’s social security scheme.

Employees also pay 1.75% of the salary towards Employee State Insurance Corporation if the gross monthly salary is less than Rs.21,000.

The table is effective for the financial year 2022-23:

Rs 0.0 – Rs 2.5 lakh : NIL

Rs 2.5 lakh – Rs 3.00 lakh : 5% (tax rebate u/s 87a is available)

Rs 3.00 lakh – Rs 5.00 lakh : 5% (tax rebate u/s 87a is available)

Rs 5.00 lakh- Rs 7.5 lakh : 10%

Rs 7.5 lakh – Rs 10.00 lakh : 15%

Rs 10.00 lakhs – Rs 12.50 lakh : 20%

Rs 12.5 lakhs – Rs 15.00 lakh : 25%

> Rs 15 lakh : 30%

Employer Costs in India

Employers bear the following costs in India:

- Provident Fund: Employers pay 3.67% towards the employees’ provident fund. They also pay an additional 8.33% towards employees’ pension plan.

- Employers also have to pay the Provident Fund authority an administration fee for managing the provident fund contributions.

Employers must comply with labor laws that stipulate the number of personal days off (or personal leave). In addition, every business must give 12 national holidays to every employee.

Employees are entitled to a minimum of 15 paid holiday days each year. But this number varies between companies and sectors. Government agencies and public sector businesses offer 30 paid holidays. Most private businesses offer between 15-30 holidays. Paid leaves can be rolled over to the next financial year.

Employers must give 12 annual holidays including Republic Day, Independence Day, and Gandhi Jayanti that are compulsory national holidays. Some states also have their own public holidays businesses must observe.

Employees usually get 15 paid sick leaves in case of any illness.

Maternity leave in India is one of the most generous in the world. Women get six months of paid maternity leave leading up to childbirth.

Paternity leave

Men get 15 days of paid paternity leave for every childbirth.

Casual Leave

This is leave that is to be used in case of an emergency or unforeseen circumstance. Most businesses give 1-2 casual leave every month. These cannot be rolled over to the next year.

Most employers offer medical and life insurance to their employees. Although India has a free public health care system, most people go to private care providers. A good medical insurance is an excellent way to attract employees who have family.

Both the employer and employee can terminate an employment agreement at will by giving the necessary notice period. No cause is needed for terminating the employment if the notice period specified in the employment agreement is given.

Usually, the notice period is one month but it can vary widely by industry and role. Typical notice period in the IT industry in India is three months.

Severance pay may be applicable based on the employment agreement.

Employers need to pay termination benefits that include payment for leaves accrued, gratuity payment if the employee worked for more than 5 years with the employer, payment in lieu of notice period if notice is not given, and any other payment as per the employment contract.